Your two-minute guide to the federal budget: Energy bill relief, rent assistance, and freeze on cost of medicines

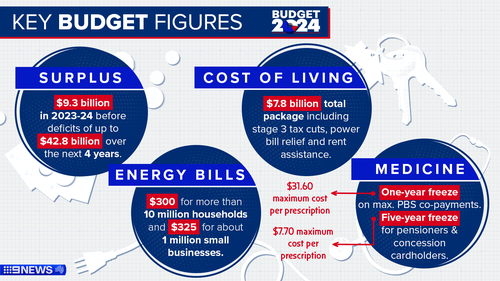

Treasurer Jim Chalmers has handed down his third federal budget, with $7.8 billion in cost-of-living relief on the way for Australian households through $300 energy bill rebates, a freeze on the cost of medicines and further rent assistance.

Chalmers said the key policies in his “budget for every Australian” are designed to combat sticky inflation while providing respite to those who are struggling.

The forecast of a $9.3 billion surplus in 2023-24 is a $10.5 billion improvement of the December prediction for the government’s bottom line, but future balance sheets are even further in the red than predicted in the mid-year update.

“This is a budget for the here-and-now and it’s a budget for the decades to come,” Chalmers said in his speech in parliament tonight.

“It’s a responsible budget that helps people under pressure today – and invests in the promise and potential of the more prosperous future we can make together.”

The $7.8 billion in cost-of-living relief includes the already legislated changes to stage 3 tax cuts from July 1, energy bill relief for households and businesses, freezes the cost of some medicines on the Pharmaceutical Benefits Scheme and offers another increase to Commonwealth Rent Assistance.

Treasury has forecast inflation could return to the target band of 2 to 3 per cent by the end of the year – much faster than the Reserve Bank of Australia’s predictions – and claims the measures included in the budget will play a key role.

“The government’s targeted cost-of-living measures are expected to reduce inflation, with energy bill relief and Commonwealth Rent Assistance expected to directly reduce inflation by 0.5 per cent of a percentage point in 2024–25 and not expected to add to broader inflationary pressures,” the budget papers state.

But even with inflation improving ahead of schedule, the budget papers do not forecast an interest rate cut until the middle of next year.

“The cash rate is assumed to gradually ease from around the middle of 2025 to reach 3.6 per cent by the middle of 2026,” the budget papers state.

Not included in tonight’s budget was an anticipated rise in the maximum rate of JobSeeker, something called for by independent government advisers.

Instead, about 4700 recipients who can work up to 14 hours a week will have their eligibility expanded to the highest rate – an increase of $54.90 per fortnight.

While the surplus makes Chalmers the first treasurer to deliver back-to-back surpluses since the Global Financial Crisis and just the fourth since the 1970s, eye-watering deficits are forecast for the coming years: $28.3 billion in 2024-25, $42.8 billion in 2025-26, $26.7 billion in 2026-27 and $24.3 billion in 2027-28.

Chalmers has cited “unavoidable spending” for the future budget blowouts, including upgrades to the myGov system and the $22.7 billion Future Made in Australia package, which aims to increase investment in industry, improve supply chains and make the country a “a renewable energy superpower” in the plan to reach net zero by 2050.

The treasurer acknowledged “fraught and fragile global conditions” but said Australia’s economy was among those best placed to thrive.

“This budget shows we are realistic about the pressures people face now – and optimistic about the future,” he said.

“It reflects our biggest ambitions and our highest aspirations to make Australians the primary beneficiaries of a world of churn and change.”

Energy bill relief

The headline new announcement in this year’s budget is $3.5 billion in relief on power bills for households and small businesses.

From July 1, more than 10 million households will receive rebates of $300 on their energy bills, while around one million small businesses will receive $325.

Medicines

Under a yet-to-be-finalised $3 billion agreement, there will be a one-year freeze on the maximum patient co-payment on the Pharmaceutical Benefits Scheme for anyone with a Medicare card.

“This year and next year, no-one will pay more than $31.60,” Chalmers said.

Pensioners and concession card holders, who receive around six out of 10 prescriptions on the PBS, will see their maximum co-payment frozen for five years at $7.70.

Rent assistance

The maximum rate of Commonwealth Rent Assistance will increase by another 10 per cent at a cost of $1.9 billion over five years.

For families with children, the increases are an additional $70 per fortnight.

It comes after a 15 per cent in last year’s budget, with the government saying nearly one million households will benefit.

Rents have increased by 7.8 per cent in the year to the March quarter.

Stage 3 tax cuts

The Albanese governments rejigged stage 3 tax cuts passed parliament earlier this year, with all 13.6 million taxpayers to receive a cut from July 1.

On average, taxpayers will receive a tax cut of $1888 or $36 per week, in 2024/25.

The budget papers say by 2034/35, someone earning an average income will pay $21,915 less tax.

“Our tax cuts are better for families, communities, women, and young people, and better for business and the economy,” Chalmers said.

Small business

In addition to the $325 in energy bill relief for around one million small businesses, the federal government is extending the $20,000 instant asset write-off for another year.

Small businesses with an annual turnover of less than $10 million will be able to immediately deduct eligible assets costing less than $20,000 until June 30, 2025.

From July 1, 457 “nuisance tariffs” will also be abolished.

“This will simplify Australia’s trade system and cut compliance costs for businesses, including small businesses which are particularly burdened by complexity of the tariff system.”